As a trader myself, I can attest that managing one’s emotions while trading is one of the most challenging things to master and can spell the difference between a successful or failed trading career.

Like with every important decision you make in life, it’s important to pay close attention to your mental state, especially if you’re a new trader who’s trying to learn the ropes.

To become a consistently profitable trader, you’ll have to master the art of staying calm even at the peak of market volatility or drawdowns, and in this write-up, I’ll try as much as possible to break down the importance of trading psychology.

If you stick around until the end, I am going to reveal some pointers that I have used to ensure that I am not trading with emotions.

Why It’s Important to Control One’s Emotions During Trading?

I cannot emphasize enough how important it is to master your emotions as a day trader. You can imagine taking a trade just before the FOMC, expecting that the results will exceed the forecast.

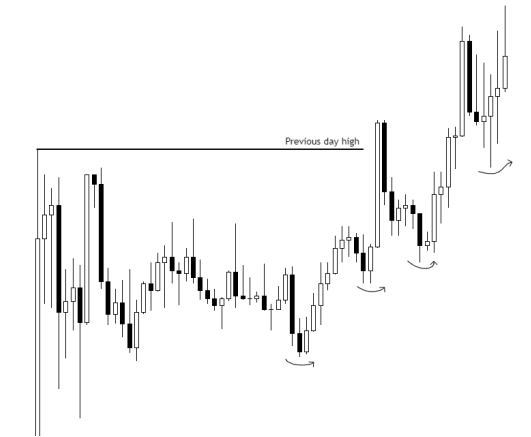

For a short period, you’re in massive profit, but the FOMC news is released, and for whatever reason, the price drops, and you stare at your screen in disbelief as the news hits you with a drawdown and the sunken feeling of you losing your account begins to sink in.

As you see the red candle stick stuck up to your increasing negative balance, you can’t help but have your emotions take over, even as you think back to all the technical analysis that you had done.

Such emotions can impair our judgment, causing us to make rushed decisions or hold onto an already losing position in hopes that the market will correct itself and we can at least close some positions at breakeven.

However, the thing about the market is that it never plays fair and is always unpredictable. Professional traders who have had some success being profitable in the forex market have, however, mastered the skill of lessening their emotions, which helps them secure their forex accounts for longer.

The Most Popular Emotions That Forex Traders Face

1. Overconfidence and Greed

As a trader, I can tell you that I have been subject to this. There have been weeks where my win-to-loss ratio has been approximately 7:2, and when you pull such feats back-to-back for more than 3 weeks, it starts getting to your head.

Afterward, you start adding on more, thinking that you are impervious and free from making any errors. You deviate from your trading plan, and sooner or later your technical analysis is wrong, and you end up burning your trading account.

This all goes to show that no matter your winning streak, always pay keen attention to your risk management parameters and don’t deviate from your trading plan. It is when you are hitting home runs that you must be most cautious.

2. Nervousness and Fear

Could it be that the reason you are experiencing that sunken feeling in your stomach before executing a buy or sell order is probably because you aren’t exercising proper position sizing?

You see, when you trade with huge position sizes, you’re increasing your market exposure, which would make you make decisions that you normally wouldn’t if you were trading with normal lot sizes.

3. Excitement

When you are certain beyond doubt that your trade is going to proceed in your anticipated and analyzed direction, then that’s what we call conviction. It’s like having a sixth sense, and in the case of trading, it can only be activated by years of repetitive backtesting and practice.

However, your conviction should not interfere with your trading plan. There are days when good trades will turn into losers, just like there are days when bad trades will turn into winners.

Such occurrences shouldn’t discourage you. Stick to your trading plan.

How Can I Successfully Control My Emotions When Trading?

Train yourself to only trade under the right market conditions.

Personally, this means staying away from the charts when high-impact news like the non-farm payroll is about to be released because it often comes with increased volatility.

– Have a Trading Plan

Your trading plans need to have solid rules related to the trading sessions when you’ll be taking trades, your risk percentage levels, your trading strategy, etc. It is by having a clear set of rules that you can lessen emotions in your trading, making room for better decision-making.

– Adjust Your Position Size

When it comes to trading, there’s always a notion that the bigger the lot you use, the faster you’ll make profits, but the opposite is also true.

You see, bigger position sizes also mean that your account has a higher probability of being wiped out should the market move in an opposite direction from what you had analyzed.

It’s important to approach trading forex from a marathon standpoint. You want to build up your equity slowly and steadily, without any qualms.

So, it’s wise to use a position size that won’t get you jittery should you happen to be in a drawdown.

Relax

Nothing exceptional ever came out of a raging mind. Learn to just sit back and relax. You’ll soon realize that you are making more rational trading decisions.