If you have been in the forex trading field for more than one or two years, then I am certain that you must have stumbled across one of the most widespread forex trading philosophies, which is commonly referred to as the ICT methodology.

For those wondering what ICT means, well, it stands for Inner Circle Trader, and this style of trading mainly focuses on pure price action and is devoid of the widespread common use of expert advisors (EAs).

To help you become more enlightened regarding ICT trading and the techniques used to extract profits from the financial markets, I am going to delve into all the details about the Inner Circle Trading model, and hopefully, you’ll be able to have a better understanding of how you can implement it into your trading strategies.

What is the ICT Concept in Trading?

The ICT trading strategy relies on some essential concepts that every aspiring trader must learn to successfully implement this trading strategy into their style. Below are some of the concepts that you can use to extract profits and trade in liaison with the big banks and market makers.

1. Displacement

In layman’s terms, displacement refers to a short, powerful burst in price movement that results in buying or selling pressure. You can easily spot a displacement happening in your charts by scanning for single, large candle groups, which may be all bullish or bearish.

Normally, these candles tend to have very large bodies with little to no wicks, which is a strong signal of agreement between sellers and buyers.

It’s also worth noting that displacements often happen after a breach in liquidity zones, which in turn creates a shift in market structure and a fair value gap.

2. Liquidity

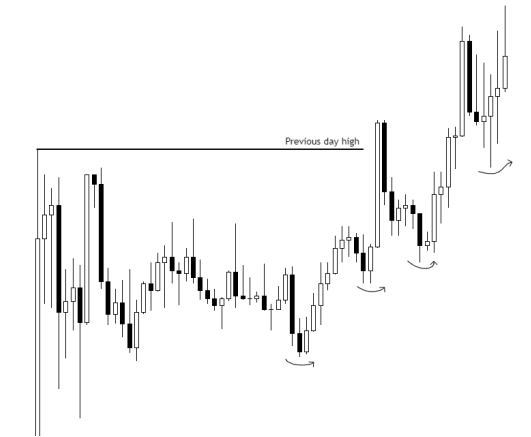

Arguably, liquidity is one of, if not the most important, concepts as far as ICT trading is concerned. Firstly, I want to inform you that there are two types of liquidity, namely, sell-side and buy-side liquidity.

Sell-side liquidity refers to areas on the chart where traders who are looking to go long in the market will position their stop losses. On the other side of the coin, buy-sell liquidity refers to areas on the chart where short-biased traders will position their stop losses in anticipation of a bearish market shift.

You can easily pinpoint the aforementioned areas at the extremes of the bottoms and tops of ranges. Normally, when a market ranges, most traders are eager to exit trades with the least loss or at breakeven, and this is where you are likely to find the most liquidity.

The market makers, or as forex traders like to call them, “smart money,” are aware of this concept, and they’ll accumulate their positions around levels where they know many retail traders have positioned their stop losses.

It’s worth noting that the market trades through an area with many stops; the market will most likely reverse and trade in the opposite directions in its quest to seek liquidity on the opposite end of the spectrum.

3. Shift in Market Structure

I’m sure you have heard the quote that most traders like to say, which states, “Follow the trend; the trend will never betray you.” Well, for novice traders who may not be familiar with identifying trends on a chart, it’s basically when the market is making higher highs and higher lows in an uptrend.

In a downtrend, the market shifts to lower highs and lower lows. An important point to note is that a shift in market structure occurs at the heels of displacements, which we discussed as the first ICT trading concept.

4. Inducement

It’s tough for the market to trend in a straight line. Quite often, you’ll notice that when the market is bearish, there will always be countertrends in the bullish direction. These tend to occur when liquidity hunting is taking place in lower time frames.

How does it happen, you may ask? Well, the price will get rejected, and in turn, it will target a short-term low or high before proceeding in the direction of the higher time frames.

Inducement targets these short-term highs and lows because these are most likely the zones where most retail traders have positioned their stops, and as you now know, liquidity hunting happens in zones where there is an influx of stops.

5. The Fair Value Gap

Fair value gaps are created within displacements, and they can be defined as instances within the markets where inefficiencies and imbalances happen. If you are conversant with ICT trading principles, then you know it’s always advisable to identify fair value gaps on the chart.

The reason is, that they act as price magnets, as prices will always seek to rectify imbalances.

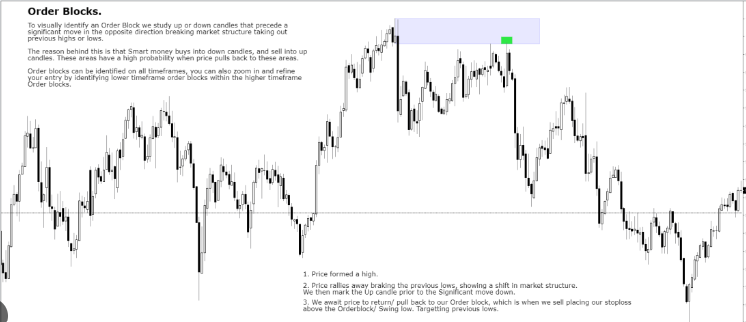

6. Order Blocks

Order blocks are specific price ranges where the big players, such as institutional banks and smart money, have previously placed sell or buy orders. Thus, it’s safe to say that there are clusters of orders around order blocks, which, as a result, impact market sentiment, liquidity, and price movement once price revisits these areas.

Final Remarks and Key Takeaways

Though the ICT trading concepts may seem outlandish and foreign, I’d urge you to try and implement some of them into your trading strategies and styles, because there have been a significant number of traders who have emulated the concepts and reaped significant rewards from the markets.

In the end, expert advisors such as Fibonacci retracement tools and trend identifiers like the moving averages will add to the confusion. Learn to look at raw price action and carry out your analysis without over-depending on indicators, because the very indicators were programmed by man. As the adage goes, “Man is to error.”