Are you frustrated and exhausted by making consistent losses every single trading day? Do you have the genuine desire to take your trading skills to the next level and attain financial independence from trading forex?

Well, this write-up will enlighten you on some of the proven trading strategies that traders have used since the onset of the financial markets to extract profits from the forex market consistently.

Due to the dynamic nature of the forex markets, many novice traders can find it daunting and frustrating to trade and get profits from the markets.

There’s always the potential to strike it big with forex trading, but what many forex gurus or experts fail to convey is that more than 80% of traders blow their accounts, especially those dominated by greed and without a proven and backtested forex trading strategy.

Why it’s Important to Have a Forex Trading Strategy

Before delving into the importance of having a proven forex trading strategy, it’s important to mention that traders should have a trading plan covering aspects of risk management, how to manage one’s emotions and the strategy they use when carrying out their technical analysis.

A well-thought-out strategy should clearly outline all the parameters that need to be met for entry and exit points in the market to eliminate guesswork. Otherwise, trading can turn into gambling, which can dent your finances if you don’t have deep pockets.

The Main Forex Trading Strategy Categories

a. ) Scalping

Traders who subscribe to the scalping strategy are focused on making profits from small or micro market movements within short periods, usually on time frames shorter than 15 minutes. However, scalping is not for everyone, as it often requires quick reflexes and decision-making skills.

Pros of the Forex Scalping Strategy

– Increased success rate

– More trading opportunities as opposed to higher time frames, like the four-hour (H4) or daily.

– Reduced exposure to risk

Cons:

– Can be strenuous and exhausting since it requires a lot of fast thinking.

– Highly sensitive to slippage

b. ) Day trading

Like the scalping strategy, day trading also has a fan base and is preferred by forex traders who don’t like operating in a fast-paced environment. Trades are executed within a 30-minute, one-hour, four-hour, or daily timeframe. It often entails opening a position and riding the momentum until the end of the day.

Pros of the Day Trading Forex Strategy

– It has a relatively low risk of exposure.

– Zero rollover expenses

– Reduces opportunity costs because of an account’s liquidity

Cons

– The strategy can be highly sensitive to volatility.

c. ) The Swing Trading Strategy

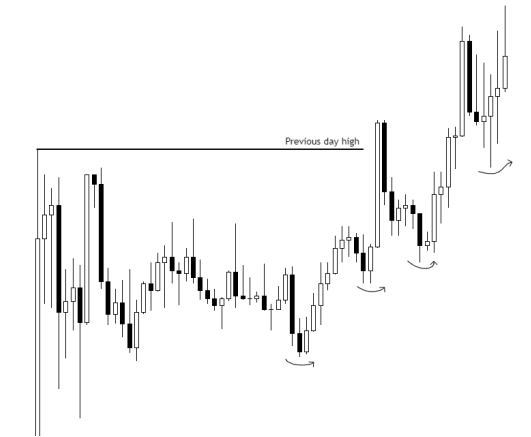

This is a mid-term forex trading strategy that often rewards patient traders with excellent results. It entails holding a position for more than two to three days and deriving profits from the markets by making note of the swing lows and swing highs.

Pros of the Swing Trading Forex Trading Strategy

– Swing traders don’t have to stress over the short-term volatility because it’s not important.

– Provided you have a solid trading plan and can pick the tops and bottoms with some degree of precision, it’s easy to experience life-changing results.

Cons

– Extra rollover cost

Proven Forex Trading Strategies for Beginners

By now, I’m certain that you have a great understanding of the three main forex trading strategy categories. Now, we are going to explore some of the proven strategy options that you could adapt and implement into your trading arsenal.

However, it’s important to note that these strategies are not impervious to risk. Thus, as a forex trader, it’s your responsibility to exercise sound judgment and implement proper risk management because, as much as the strategies will increase your odds of making profits, there are days when you’ll experience losses.

So, take time to back-test these strategies or get a demo account and use these strategies there for some time before getting a live account.

1. The Support and Resistance Forex Trading Strategy

This is a strategy that produces excellent results when the currency pair that you are trading is ranging. The logic behind the strategy is that the market will turn bearish at a level of resistance and bullish at a level of support.

Many tools, like Fibonacci and Bollinger bands, can also be used to establish support and resistance levels, and traders have the freedom to settle for a tool that they’re comfortable using.

2. The EMA Crossover Trading Strategy

Arguably, it’s one of the most used forex trading indicators and strategies worldwide, and forex traders love using it because it helps them establish a direction bias on any chart at a moment’s glance.

Thus, you can execute trades with some degree of confidence, knowing that the odds are stacked in your favor. Quite often, traders employ EMA crossover strategies of different values (one higher and the other lower) and then enter the market based on the direction of the cross.

One of the most common EMA crossing combos is the 13 and 26 crossover strategy.

3. The London Breakout Forex Trading Strategy

Over the years, many traders have noted that the direction of most forex currency pairs is determined at the London open trading session.

To effectively use this strategy, you should mark the highs and lows of the Asian session and buy when a candle closes above this range or sell when a bearish candle opens below this trading range.

It’s advisable to position your stop loss below the lowest trading range of the Asian trading session during buys and vice versa for sales. Always aim for a 1:2 risk-to-profit ratio.

Important Rules to Bear in Mind When Using Forex Trading Strategies

1. Keep an Updated Trading Journal – Recording all the details of the trades you take daily is the fastest way to improve your trading prowess.

2. Keep Your Emotions in Check – If you want to have a chance at being a consistently profitable forex trader, then you must learn to keep your emotions in check. That’s why it’s advisable to have a detailed plan. Plan the trade, trade the plan, and don’t deviate from it.

3. Set Realistic Profit Targets – Manage your greed, especially when you have had consecutive winning streaks. Also, always remember to check the volatility levels of the currency pair you are trading. The more volatile the currency pair, the higher the profit target you should set.

Conclusion

Forex trading can be a promising and rewarding career if done correctly, and that’s why traders should have a trading plan with well-thought-out, proven, and backtested trading strategies. Don’t choose a strategy based on your friend’s recommendation or what some forex guru who makes money selling courses on YouTube told you.

Rather, you’ll need to choose a plan that fits in with your lifestyle and your personality. Lastly, don’t go in blind with a live trading account without trying the strategy on a demo account over a period.